Again, using the historical spending reported in the OMB 2012 Budget, there are two striking graphs on Government Receipts as a Percent of GDP that caught my eye.

As you can see, Individual Income Tax Receipts as a Percent of GDP rose dramatically in 1944 from around 1% to 7.3% during the war and then remained relatively flat at 8% level. Since 1944, the top Individual Tax Rate steadily dropped from 94% to the current 35%. The lowest Individual Rates went from 23% in 1944 and bounced around until hitting the current rate of 10% in 2002. In spite of these reductions, the ratio of has remained around 8%. However, the Corporate Tax shows a very different picture.As with Individual Tax Receipts, the Corporate Tax Receipts as a Percent of GDP rose in 1944 from about 1% to near 5% during the war. In 1951 it bumped up to 6% but then began a steady decline over the next 30 years down to a stable average near 1.8%. The top Corporate Tax Rates over this timeframe went from 53% to the current 15% while the lowest rates went from 29% to 15%. (The Effective Corporate Tax Rate is near 13% which is 5th lowest among OECD countries, as reported by the US Department of Treasury based on an average from 2000 to 2005.)

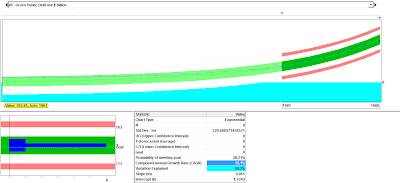

Since the Corporate rates dropped less than for Individual rates but the Corporate Receipts as a Percent of GDP dropped while Individuals did not, it must mean that Corporations started making much less profit while individual incomes must have risen relative to GDP from 1950 to 1980! This does not seem plausible! So another explanation is that Corporations began to get many more tax breaks (loopholes?) than Individuals did. Therefore, the news reports of taking away tax loopholes for corporations could be an appropriate way to increase Government Receipts, especially if this were to return the Corporate Tax Receipts as a Percent of GDP back to the post war level of 5% - 6%. This would be an increase of receipts of 3.5% of GDP which would help reduce the annual deficit by $500B / year or $5 Trillion over the next 10 years in the ballpark the Super Committee has been asked to deliver by the 100.

But another side of the debate has been how high the current Corporate Tax Rates are relative to the rest of the world. It is true, that with federal, state and local included, the Corporate Rate in the US the second highest, behind Japan. However, Corporate Tax Receipts as a percent of GDP in the US are the SECOND LOWEST of the OECD countries. The lower tax rate countries have closed tax loopholes in their countries while we have created them! To be precise, as reported by the Government Accountability Office, tax loopholes, deductions, credits and subsidies reduced tax reciepts in 2010 by $1 Trillion for both Corporate and Individuals. So it seems that the Corporate Loopholes are about half of this $1 Trillion total.

For reference, in 2009, here is the US ranking (highest tax is a high rank) among the OECD countries in taxes as a percent of GDP:

Total Taxes: 26 out of 28 (second lowest) Note: Taxed Enough Already......don't think so!

All Income Taxes: 19 out of 29

Personal Income Taxes: 15 out of 26

Corporate Income Taxes: 25 out of 26 (second lowest)

Social Insurance Taxes: 18 out of 28

Consumption Taxes: 29 out of 29 (lowest)

Property and Wealth Tax: 4 out of 28 (fourth highest)

All of this information seems to support that we, as a nation, should be able to afford an increase in taxes to Corporations and even Consumption (Sales Tax Plans!).