The news media is reporting today that the Social Security Disability Fund will go broke in 2017 due to the sudden increase in claims by people disabled and out of work. Sorry to say, that this is NOT new news! The 2012 Budget estimates projected this same catastrophe months ago, but it is only making the news now. Here is the forecast of the Social Security Disability Trust Fund Balance through 2018, when it was forecasted to be a negative balance.

As you can see, the Disability Trust Fund started shrinking at a rapid pace starting in 2008, so the crisis in this Trust Fund started three years ago.

The news today reported that claims are exptected to rise by as much as 50%. Should this occur through 2012, this fund will go negative in 2012! Why is this important to us?? Last time the Disability Trust was in trouble, is was rescued by the Social Security Trust Fund. In my post of May 23, 2011 titled "Social Security and Medicare Cost per Person", I projected the Social Security Trust Fund would last through 2050. The fact that payroll taxes have been cut for 2011 and likely through 2012, will certainly change this 2050 date, but it appears that Social Security supporting the Disability Fund is a low risk option in the short term. However, now this makes me want to update my Social Security and Medicare cost per person forecasts based on the low GDP growth expected over the next several years.

Through the use of statistical tools, get an alternative view of of the facts reported in the news

Monday, August 22, 2011

Best and Worst Presidents for the Economy

After publishing my previous post titled "Best and Worst Presidents Relative to Debt Growth" (8/17/2011), my long held beliefs were rattled. So I decided to dig a bit deeper into the Government Data on the economy, specifically the GDP. In my investigation and analysis, I had noticed GDP numbers that I could not reconcile. I finally found the problem when I got to the Bureau of Economic Analysis. http://www.bea.gov/national/nipaweb/SelectTable.asp?Popular=Y

The bottom line is that two GDP numbers are used. The GDP (sometimes "nominal"GDP) is the value of Goods and Services, priced using each year's (or quarter's) actual prices. The Real GDP is calculated using a constant price for all years, essentially removing the effect of inflation. When a percentage change is calculated on Real GDP, it reflects the real growth in economic output by removing "growth" due to price inflation. Said another way, Real GDP is the actual volume of goods and services produced during any period. A high GDP growth driven by high inflation would not necessarily be a job creating economy. However, a high growth of Real GDP is more likely to create jobs since additional goods and services are being produced.

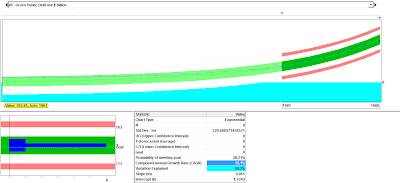

So I decided to look at the same Presidential Terms as were analyzed in my previous post, but this time with a focus on GDP compound growth both Real and Nominal. As an example of the technique, below are two graphs for Reagan's Term on GDP Growth and Real GDP Growth (these graphs are described in my previous post).

The table below summarizes the results for all Presidential Terms. Included is a column for the first 10 Quarters of each Presidential Term so that Obama's Term to Date results can also be included.

As you can see, the lowest GDP and Real GDP growth rates occur on Republican Terms and the highest are during Democratic Terms. This led me to calculate an average for all Democratic Terms and all Republican Terms. (Each average has a single term President). Again, the Democrats have done better in all categories when it come to Economic growth and, by inference from Real GDP, job growth as well. All this data is really getting me to rethink my political affiliation!

The bottom line is that two GDP numbers are used. The GDP (sometimes "nominal"GDP) is the value of Goods and Services, priced using each year's (or quarter's) actual prices. The Real GDP is calculated using a constant price for all years, essentially removing the effect of inflation. When a percentage change is calculated on Real GDP, it reflects the real growth in economic output by removing "growth" due to price inflation. Said another way, Real GDP is the actual volume of goods and services produced during any period. A high GDP growth driven by high inflation would not necessarily be a job creating economy. However, a high growth of Real GDP is more likely to create jobs since additional goods and services are being produced.

So I decided to look at the same Presidential Terms as were analyzed in my previous post, but this time with a focus on GDP compound growth both Real and Nominal. As an example of the technique, below are two graphs for Reagan's Term on GDP Growth and Real GDP Growth (these graphs are described in my previous post).

The table below summarizes the results for all Presidential Terms. Included is a column for the first 10 Quarters of each Presidential Term so that Obama's Term to Date results can also be included.

As you can see, the lowest GDP and Real GDP growth rates occur on Republican Terms and the highest are during Democratic Terms. This led me to calculate an average for all Democratic Terms and all Republican Terms. (Each average has a single term President). Again, the Democrats have done better in all categories when it come to Economic growth and, by inference from Real GDP, job growth as well. All this data is really getting me to rethink my political affiliation!

Wednesday, August 17, 2011

Best and Worst Presidents Relative to Debt Growth

So much talk about the Debt lately is making my head spin and my previous posts have just created more questions. I decided to look at the COMPOUND ANNUAL GROWTH of the National Debt under each President to see how they did. This approach does not "punish" a President for what they inherited, but what happened after they took office. I used Presidential terms from the inauguration year to their last full year and I put Kennedy/Johnson together as a term and likewise for Nixon/Ford. I also generated numbers for Obama with only 2 years completed and his third year estimated, but I will present these only in comparison to the other's results.

I also evaluated each President on the GDP Growth as well as the components of Debt: Receipts (including Individual and Corporate Taxes), Outlays, Deficit, and Supplemental. As for "good" or "bad" evaluations, I am assuming higher Receipts is good and lower Outlays are good which lowers the deficit and the debt. I recognize that certain political philosophies may not support these being "good".

The President with the highest growth rate on Debt was Ronald Reagan, yes Reagan! He also had the highest growth rate in Supplemental spending. Obama would have come in second to Reagan if we used his 2+ year performance. Below is Reagan's Debt growth rate of 15.1% followed by his Supplemental growth of 46.6%

I also evaluated each President on the GDP Growth as well as the components of Debt: Receipts (including Individual and Corporate Taxes), Outlays, Deficit, and Supplemental. As for "good" or "bad" evaluations, I am assuming higher Receipts is good and lower Outlays are good which lowers the deficit and the debt. I recognize that certain political philosophies may not support these being "good".

The President with the highest growth rate on Debt was Ronald Reagan, yes Reagan! He also had the highest growth rate in Supplemental spending. Obama would have come in second to Reagan if we used his 2+ year performance. Below is Reagan's Debt growth rate of 15.1% followed by his Supplemental growth of 46.6%

The highest growth rate of yearly deficits occurred under Bush 2 at 63.8%. The Obama growth over the 2+ years is 6.3%. Below is the Bush 2 graph for Deficits.

To summarize all this data, I created a table of all the contributors to Debt: Receipts, Outlays, Deficit, Supplemental Spending, Debt and GDP. Then identified the 2 highest growth rates and the 2 lowest growth rates and assigned a point each time a President's term appeared. Again, I used high Receipt growth and low Outlay growth as "good" and of course the converse as "bad".

The two highest point totals for "Best Debt Presidents" are: Clinton and Carter, each with 5 points. The next highest had 2 points.

The two highest point totals for "Worst Debt Presidents" are: Bush 1 with 5 points; Bush 2 and Nixon/Ford each had 4 points. The next highest had 2 points. This suggests that the Republicans are "worse" for our Debt while Democrats are "good" for our Debt. Isn't that a switch??

To note: Clinton and Carter both had higher GDP growth rates than Bush 1 or Bush 2 (5.8%, 11.2%, 4.8%, 5.4% respectively. I thought Republicans were "good" for the economy??

The entire table follows, including the Obama number for his 2+ years for compaison. Had Obama's term been included, there would be NO Change in the "Best" Presidents, but Obama would have replaced Bush 2 in "Worst" Presidents with all of them getting 4 points.

A few more comments on the internals:

- Carter and Clinton had the highest growth rates on Individual Income Taxes (16.1% and 10.4%) while the highest growth in Corporate Income Tax was during Bush 2 and Reagan (16.5% and 9.2%). I would have expected all these to occur during the strongest ecomonies, or highest GDP growth but they did not. Who is business friendly again?? Who is looking out for the average american again??

- Payroll tax (Social Security and Medicare) grew 3.0% faster than Individual Income Tax growth until 1990 when the Payroll Tax Rate shrank 3.8% faster. There have not been any Payroll tax increases since 1990. (Remember payroll taxes have been decreased recently while our trust funds are going bankrupt)

- Only Clinton and Carter had Receipt growth higher than GDP growth by 1.3%. (Higher Taxes??) All other Presidents had Receipt growth LOWER than GDP growth. Shouldn't the government benefit from a good economy?

- Government spending grew on average (per 8 year term) by 6.8% for Republicans and 5.1% for Democrats. I thought Democrats were the ones who grew the government??

Friday, August 12, 2011

The Super Committee Needs to Update the Budget / Debt Assumptions

Although the 12 members of the "Super Committee" have now been chosen, I was reading an AP article this week by Alan Fram titled "Latest Picks for the Debt Panel Spark Some Pessimism" several comments caught my eye and triggered some other thoughts about the National Debt and the 2012 Budget. [Doesn't the term Debt Panel sound very familiar to the Death Panel in prior news reports]

http://denver.xfinity.comcast.net/articles/news-general/20110809/US.Debt.Super.Committee/

In this article and throughout the news, the phrase of "trimming $1.5 trillion in debt over the next decade" clearly is the challenge to this 12 member committee. But how misleading are these phrases. In truth, the panel's only requirement is to reduce the growth of the debt over the next decade, NOT to trim $1.5T from the current debt! Just to be clear let me state some basic facts about the debt and the 2012 US Budget.

Now with this background estabished, how could a slight reduction in the debt be achieved by the committee. I would start by looking at the big ticket items in the budget which many of you may know already, but there was one surprise for me. And also note that Non-security discretionary spending represents only 9.9% of all outlays over the next 10 years!

National Defense is the largest and is part of the Discretionary or Appropriated Programs. The total Discretionary budget over these 10 years is $14.14 T of which Defense is 2/3's. So, a 10% reduction over these 10 years would just about do it! Skipping Social Security for a moment, the next largest, is Income Security. This includes Federal Employee Retirement, Unemployment Compensation, but also includes Housing Assistance, Food/Nutrition Assistance, and Other. Putting a 10% reduction on just part of this area would easily obtain the other $.10 T. JOB DONE!

But lets get real in the context of the current politics, current economic conditions, S&P downgrade and the requirement of a Balanced Budget Ammendment vote. The Democrats want to maintain all the social programs and the Republicans want to be revenue neutral. In the paragraph above, you can see that is quite possible.

But we must now put the entire 2012 Budget up against the current economic realities. What ecomonic assumptions are built into the Budget? GDP growth is forecasted to be 5.1% compounded annually for these 10 years as you can see below.

Looking at the previous 20 years from 1988 to 2008 (Great Recession), the compound GDP growth was 5.4%.

Many financial experts are now forecasting that US GDP growth will more likely be in the 2 - 3% range in the new global ecomony. This certainly will have some effect on the predcited Goverment Receipts, especially Income Tax Receipts. Below is the Individual Income Tax forecast in the Budget.

So the Budget is assuming a 9.7% compound growth in Income Tax collected when the GDP budgeted growth is only 5.1%! Has the tax growth been this high recently? In the chart below, the same period from 1988 to 2008 is evaluated.

Lets try to quantify this $7.8T in what this would mean in spending cuts based on the current 2012 Budget spending.

http://denver.xfinity.comcast.net/articles/news-general/20110809/US.Debt.Super.Committee/

In this article and throughout the news, the phrase of "trimming $1.5 trillion in debt over the next decade" clearly is the challenge to this 12 member committee. But how misleading are these phrases. In truth, the panel's only requirement is to reduce the growth of the debt over the next decade, NOT to trim $1.5T from the current debt! Just to be clear let me state some basic facts about the debt and the 2012 US Budget.

- The current National Debt is $14.5 Trillion

- The estimated 2011 Government Receipts are $2.17 Trillion, with Outlays of $3.77 Trillion for a 2011 Deficit of $1.60 Trillion

- Over the next 10 years, to 2021, Government Receipts total $37.93 Trillion with Outlays of $47.32 Trillion for an 10 year deficit of $9.39 Trillion.

- This creates a National Debt in 2021 of $24.86 Trillion. Remember that this does not include any Supplemental Spending which I discussed in my posting 3/10/2011 titled "Annual Deficits and the National Debt"

- Over the past 10 years, through 2010, Supplemental Spending totaled $3.45 Trillion which could therefore, increase the 2021 National Debt to $28.31 Trillion!

- So the job of this "Committee" is to reduce the 2021 Debt to $23.36 Trillion (or $26.81T if you add supplemental spending). Again for reference, the current Debt is $14.5T.

- This will only reduce the Growth of the Debt from 4.85% to 4.21% compounded annually.

Now with this background estabished, how could a slight reduction in the debt be achieved by the committee. I would start by looking at the big ticket items in the budget which many of you may know already, but there was one surprise for me. And also note that Non-security discretionary spending represents only 9.9% of all outlays over the next 10 years!

National Defense is the largest and is part of the Discretionary or Appropriated Programs. The total Discretionary budget over these 10 years is $14.14 T of which Defense is 2/3's. So, a 10% reduction over these 10 years would just about do it! Skipping Social Security for a moment, the next largest, is Income Security. This includes Federal Employee Retirement, Unemployment Compensation, but also includes Housing Assistance, Food/Nutrition Assistance, and Other. Putting a 10% reduction on just part of this area would easily obtain the other $.10 T. JOB DONE!

But lets get real in the context of the current politics, current economic conditions, S&P downgrade and the requirement of a Balanced Budget Ammendment vote. The Democrats want to maintain all the social programs and the Republicans want to be revenue neutral. In the paragraph above, you can see that is quite possible.

But we must now put the entire 2012 Budget up against the current economic realities. What ecomonic assumptions are built into the Budget? GDP growth is forecasted to be 5.1% compounded annually for these 10 years as you can see below.

Looking at the previous 20 years from 1988 to 2008 (Great Recession), the compound GDP growth was 5.4%.

Many financial experts are now forecasting that US GDP growth will more likely be in the 2 - 3% range in the new global ecomony. This certainly will have some effect on the predcited Goverment Receipts, especially Income Tax Receipts. Below is the Individual Income Tax forecast in the Budget.

So the Budget is assuming a 9.7% compound growth in Income Tax collected when the GDP budgeted growth is only 5.1%! Has the tax growth been this high recently? In the chart below, the same period from 1988 to 2008 is evaluated.

As you can see, the compound growth over these 20 years is only 5.4%, which is very close to the GDP growth. Seems the budget is a bit agressive on these assumptions, and it is much the same for Corporate Income Tax. But, what would happen over these 10 years if the Government Receipt growth was much lower? Of course it would add to the future deficits and debt! But how much? If we grew total Receipts at only 5%, this would add an additional $9.22 T to the debt. If Receipts grew at only 3%, the debt would increase by $12.22 T!

Putting this all together, how does the country look in 2021, assuming 3% GDP growth, 5% growth in Tax Receipts (agressive), no new taxes, and an additional $1.5 T deficit reduction by the committee (plus the $.8T already done, gives $2.3T). This would produce a National Debt in 2021 of

$31.78 T (assuming no Supplemental Spending). If we held the Publicly held debt around 70%, it would produce a Net Government Debt of 111% of GDP. For reference, currently we are 72%, Greece is 152%, Ireland is 95%, Italy is 101% and Japan is 128%. For the US to stay at our 72%, the Super Committee would need to find an additional $7.80 T in spending cuts! Lets try to quantify this $7.8T in what this would mean in spending cuts based on the current 2012 Budget spending.

- Cut All Discretionary Spending (Security and non-Security) by 55%

- Eliminate Social Security, Medicare and Medicaid (Including Receipts)

- Cut all Non Security Discretionary and Medicaid Spending

Subscribe to:

Posts (Atom)